reverse tax calculator formula

Do you like Calcul Conversion. We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

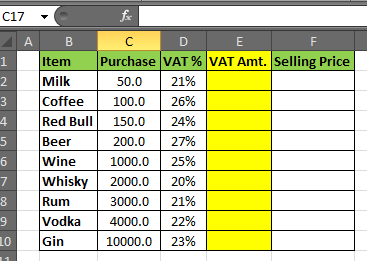

Formulas To Include Or Exclude Tax Excel Exercise

Reverse Sales Tax Calculations.

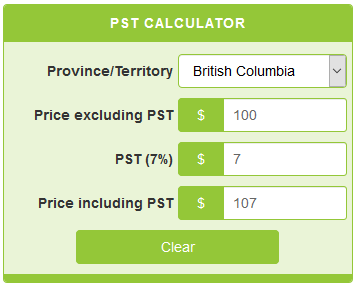

. Calculates the canada reverse sales taxes HST GST and PST. 06 r6 100sum p5q5 p6 o6p5. For your convenience I have included the following mini calculator to find the sales tax rate.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Amount without sales tax x HST rate100 Amount of HST in.

Sale Tax total sale. This reverse sales tax calculator will calculate your pre-tax price or amount for you. Notice my main language is not English.

Formula for reverse calculating HST in Ontario. Price before Sales Tax Final Price 1 Sales Tax. New Brunswick Newfoundland and Labrador Nova Scotia.

Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. Divide the percentage added to the original by 100. The reverse sale tax will be calculated as following.

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. For example if a sales tax of 6 percent was added to the bill to make it 212 work out. Here is how the total is calculated before sales tax.

Collecting Sales Tax Like income tax calculating sales tax often. Enter the final price or amount. Amount with sales tax 1 HST rate100 Amount without sales tax.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Net Income - Please enter the amount of Take Home Pay you require. You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula.

Tax reverse calculation formula. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

6 1 0 0 0. X 100 Y result. Amount with taxes Canada Province HSTQSTPST variable rates Amount.

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount. You can calculate the reverse tax by dividing your tax receipt by 1 plus. This is the after-tax amount.

Sales tax is calculated by multiplying the sales tax rate by the total pre-tax cost. The formula looks like this. You will need to input the following.

You can use tax rates from 2013 to 2002 and specify. Formulas to Calculate Reverse Sales. Reverse Sales Tax Formula.

Calculate the canada reverse sales taxes HST GST and PST. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. This is the NET amount after Tax the.

6 100 006 6100. I appreciate it if. To make things simple you can also depend on the reverse percentage calculator.

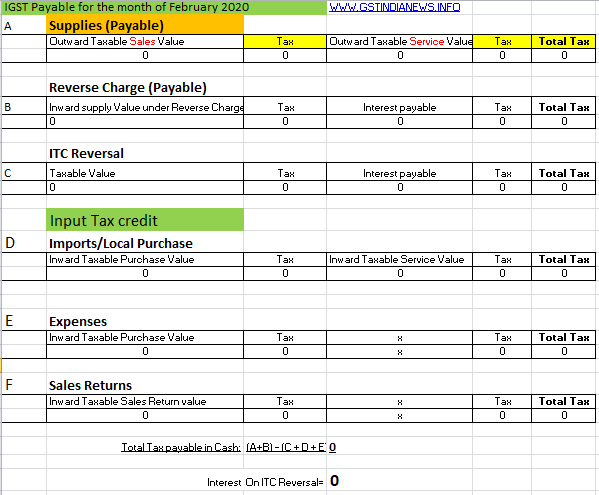

Calculation Of Gst Based On Slab Rate Cess On Quantity And Value

Fastest Sales Tax Reverse Calculator 2022 2023

Income Tax Formula Excel University

How To Calculate Sales Tax In Excel

Easiest Capital Gains Tax Calculator 2022 2021

Tip Sales Tax Calculator Salecalc Com

Sales Tax Calculator Double Entry Bookkeeping

Net Income After Tax Earnings Formula And Calculation

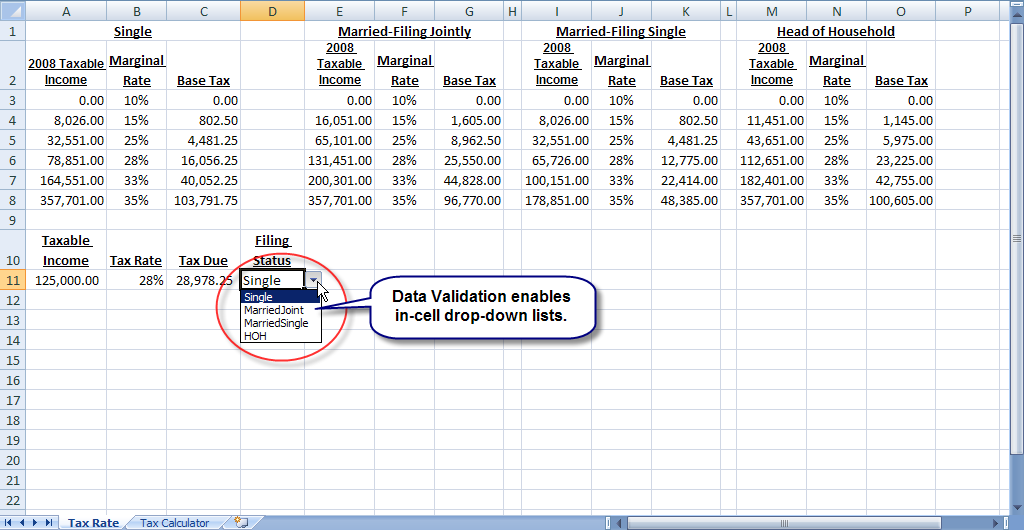

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

How To Calculate Sales Tax In Excel

Pst Calculator Calculatorscanada Ca

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Reverse Stock Split Formula Ge Example And Calculation

Best Excel Tutorial How To Calculate Gst

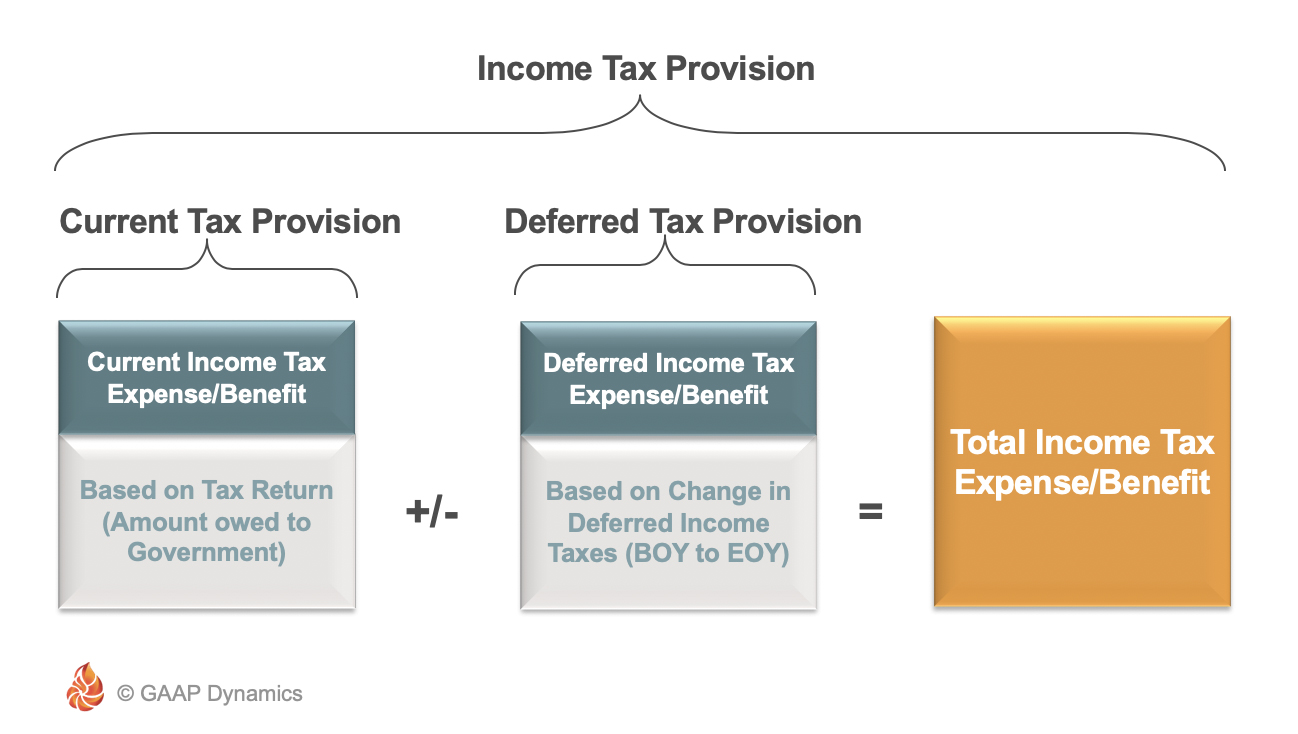

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics